From the acquisition of 21st Century Fox by Disney to the introduction of the Euro or the first iPhone, different events have had a significant impact on the market throughout history. Whether it’s positive or negative, traders and investors need to be prepared.

Interestingly, Warren Buffest once invested in Bank of America, and after the positive news from the Federal Reserve about interest rates, BAC’s stock price increased by over 100% in just a few years.

Are you prepared for a major event? While no one can predict the future, it helps to look back at the past and analyze what historically went on after big news. Before the next one occurs, let’s explore the topic.

Quick recap: what is a trading day, and what constitutes a major event?

A trading day is a regular day on which the market is open for business. On these days, investors can buy and sell assets based on the news and events of the day. For example, a trading day on the stock market, specifically the New York Stock Exchange, starts at 9:30 am ET and ends at 4 pm ET, Monday to Friday. A forex trading day is slightly different, with trading occurring 24 hours a day, 5 days a week.

As for a major event, it could be anything that causes fluctuations in asset prices, such as:

- Election results

- Technological breakthroughs

- Corporate earnings reports

- Interest rate changes

- Trade agreements

- Geopolitical tensions

Factors that affect the market’s reaction

Major events cause market fluctuations in one way or another. But the market’s reaction to such events is not always straightforward and can be influenced by a multitude of factors. Some of the most influential ones are:

- Expectations – If the event is largely expected, the market may be already priced in anticipation of the impact; hence, a more muted reaction. If it’s a surprise, there’ll likely be a bigger reaction.

- Magnitude – A small company announcing a new product may have a limited impact. But a major government policy shift could have a widespread impact on multiple industries and markets.

- Duration – The longer the impact, the more prolonged the market reaction.

- Timing – If the event occurs during a time of heightened market volatility or uncertainty, it will magnify the fluctuations.

- Market sentiment – Let’s say investors are already feeling bullish. In that case, a positive event (like the release of favorable economic data) should further boost their confidence and increase buying activity. And vice versa.

Positive vs. negative events

The Biogen and Facebook cases are two illustrative examples of what positive and negative events can do to the stock market.

In February 2023, Biogen announced that its drug Aduhelm, which treats Alzheimer’s disease, received approval from the FDA. This news led to a surge in Biogen’s stock price, with the share price increasing by more than 60%. But because it was only a company-wide event, it didn’t have a significant impact on the overall market.

On the other hand, Facebook became the center of numerous discussions in 2018 because of its involvement with a third-party firm Cambridge Analytica. This event had a significant impact not only on Facebook’s stock price but also on the overall market. The incident brought attention to the importance of data privacy and security in the wider tech industry.

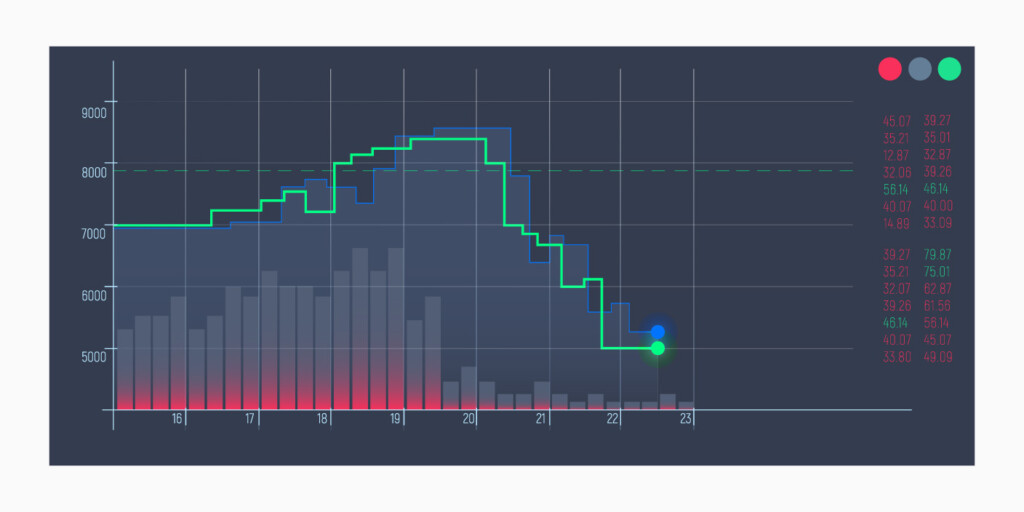

A sample scenario: significant volatility

In this example, the market perceives an event as having a significant impact on the economy. It may be a sudden geopolitical crisis or a major announcement from a central bank. The following trading day, the event may cause a sharp sell-off in the equity markets. The sell-off could continue throughout the day, thus increasing volatility and wide swings in prices.

Some investors will also jump to safe-haven assets like gold and US Treasury bonds.

Another scenario: a calmer reaction

What if the market perceives the event as having a milder impact? A calmer reaction follows events like a better-than-expected earnings report or economic data that comes in stronger than anticipated. It may cause a small bump in the equity markets and a slight rise in bond yields the next day.

Expect some initial buying as investors react to the positive news, but no meaningful volatility or swings in prices.

How to make sound investment decisions after a major event

“As discomforting as the headlines are, from an investment perspective, we would urge investors not to overreact,” wrote Lindsey Bell, Ally’s chief markets and money strategist. “Panic selling has generally not been a winning strategy.”

Now that you know what may happen, let’s see what you can do. Here is an event trading strategy you can initiate the day after:

- Assess the impact of the event. How will the event affect the asset you’re considering investing in? If it’s a technological innovation, consider investing in the company that produces the tech. If it’s a negative event, like a natural disaster, consider the impact on the insurance, construction, and energy industries.

- Review market sentiment. A lot of fear and uncertainty is not a favorable sign for taking action.

- Look at historical trends. What was the market’s historical reaction to similar events in the past? This may indicate the outcome and the timeline for this event, too.

- Diversify. Consider going long on assets that are less affected by the event or those from different industries.

- Set stop-loss orders. Finally, place stop-loss orders in case the market moves against you.

You won’t always be able to capitalize on major market events or turn them into favorable opportunities. But it’s possible to navigate the twists and turns of the market as long as you stay on top of the news and manage your risk.

Sources:

When corporate scandal hits retail investors close to home, LSE

Biogen and Sage Therapeutics announce FDA accepts filing of new drug application, Biogen

How Cambridge Analytica sparked the great privacy awakening, Wired