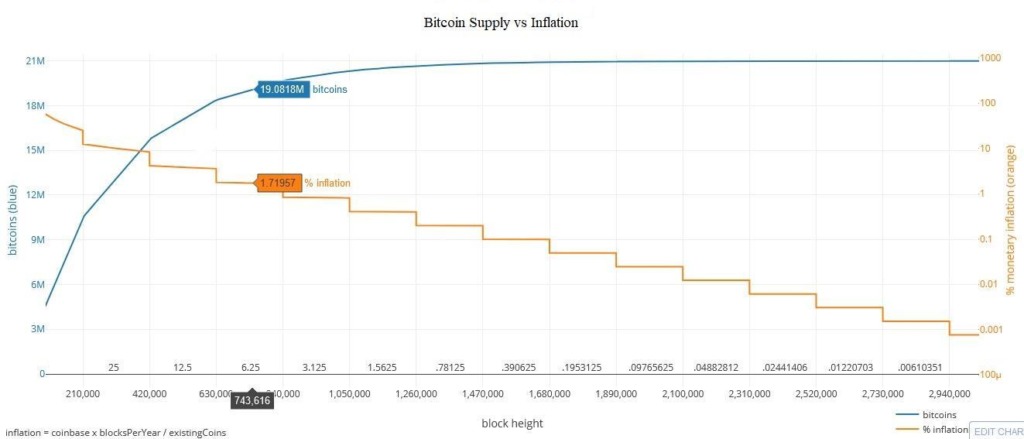

We already know that bitcoin has a supply cap of 21 million BTC. This means no more BTC can be mined once this supply cap has been reached. Currently, the number of bitcoin in circulation is slightly over 19 million, and it’s expected to hit 21 million by 2140. So, what will happen once all bitcoins are mined?

Before we get into it, let’s first discuss how BTC is mined and its supply schedule.

How is bitcoin mined?

Contrary to popular belief, mining doesn’t mean generating new cryptos. New bitcoins are issued to reward miners for keeping the network safe. For any transaction to be added to a blockchain, it must be verified by the computers on the blockchain. This is done through the process of mining.

The sole function of miners is to validate the transactions and attach a new block containing the confirmed transactions to the blockchain. The miner receives a reward of 6.25 BTC for each block added to the blockchain.

Currently, one Bitcoin block is generated about every ten minutes. That means the supply of BTC increases by 6.25 every ten minutes. So, will all bitcoins ever be mined? Yes, at this rate, we can expect all bitcoins are mined around 2140. And oddly enough, once all bitcoins are mined, the total BTC in circulation won’t be 21 million. According to Chainalysis, almost 20% of the total BTC supply will be permanently lost.

How many bitcoins are not mined?

As of June 2022, about 1.923 million bitcoins are not mined yet.

As we mentioned, the supply of BTC increases by about 6.25 BTC every 10 minutes. In theory, we can expect that the remaining 1.923 million BTC should be mined in the next 5.85 years. But in reality, this isn’t the case. All bitcoins are expected to be mined by the year 2140. This is because of bitcoin halving.

What is Bitcoin halving?

Bitcoin halving the reduction of the mining rewards by 50% after every 210,000 blocks have been mined, which occurs after every four years. This is the most crucial factor determining the supply schedule of bitcoin.

At its launch in 2009, the reward for mining a block amounted to 50 BTC; four years later, during the first halving in 2012, the remuneration was cut to 25 BTC. The second halving was in July 2016, and the rewards were cut to 12.5 BTC per block. The most recent bitcoin halving was in May 2020, which resulted in the current mining reward of 6.25 BTC per block. The next halving is expected in 2024 and will reduce the rewards to 3.125.

The biggest implication of halving is reducing the growth of the bitcoin supply.

So, what happens when all bitcoins are mined?

What happens when all bitcoins are mined?

As discussed, the last bitcoin will be mined by the year 2140. The impact when all bitcoins are mined will be on the miners and bitcoin users.

Impact on miners

Assuming that no changes will be made to bitcoin’s protocol to increase the supply, miners will not receive new bitcoins to verify the blocks. Miners will still be needed to verify and approve transactions and add them into blocks. And although they won’t be rewarded with new bitcoins, they will only receive the transaction fees.

However, one point of contention is that the fees might be too low compared to the current mining rewards. Currently, mining rewards include the newly minted BTC and transaction fees. The transaction fees are just an added incentive for miners to approve a transaction quicker.

Admittedly, bitcoin mining requires expensive hardware. Currently, miners offset the cost of mining using the block rewards and the transaction fees they receive. But as we’ve discussed, bitcoin halving tends to reduce miners’ rewards. And this will further be compounded when all bitcoins are mined.

However, it’s fair to anticipate that by 2140, the bitcoin community will be significantly larger, which means more transactions. The more the transactions, the more the rewards to the miners. And given that the current transaction fees are low, it’s expected that as bitcoin adoption grows, the increased demand will also lead to a partial increase in the transaction fees to compensate the miners.

Impact on users

The perceived expansion of the community and the limited supply of BTC will make it a scarce asset. Bitcoin’s supply will be scarce, which could eventually lead to an increase in price. When all bitcoins are mined, it will officially become deflationary.

Thanks to halving, bitcoin’s inflation is cut into half every four years. In the 2020 halving, for example, its inflation rate dropped from around 3.7% to around 1.8%. This means that when all bitcoins are mined, the smallest unit of BTC (satoshis) will have more purchasing power.

The bottom line

Has all of bitcoin been mined? No; currently, a little over 19 million bitcoins have been mined – about 90.84% of the maximum supply of 21 million. So, what happens when all bitcoins are mined? Firstly, miners won’t receive new BTC as block rewards; they will be compensated through transaction fees. And secondly, Bitcoin’s supply will be scarce, which could eventually lead to an increase in price.As block reward nears zero, transaction fees are expected to increase to incentivize miners. However, with about 120 years left until all bitcoins are mined, it’s possible that more efficient protocols like the Bitcoin Lightning Network will provide cheaper and faster solutions for bitcoin users.