Most new traders lose their initial account in less than six months because they don’t have good risk management tools or trading methods when they begin trading. The majority of them don’t make it to the fourth year in trade.

We’ll go over some of the most common mistakes new traders make and some tips for new traders to solve them.

#1. Trading with emotions

The success of your trading path will be determined by your trading psychology and ability to handle emotions.

Some traders, no matter how smart, are unable to cope with the stress of trading and fall prey to emotional decision-making. Making rash judgments based on fear, disappointment, hatred, extreme optimism, or greed is one of the most dangerous things you can do to yourself as a trader.

Following your trading plan is the best way to keep your emotions under control. Always keep in mind the factors and research that led to your trading decision. Keeping a trading notebook might also help you manage your emotions regarding trading. Entry and exit points, as well as an emergency exit, should be included in all trading plans in case anything goes wrong and you need to preserve your capital.

#2. Overtrading

Overtrading is undoubtedly one of the most common trading mistakes new traders make.

Some traders monitor 20 charts, 10 different currency pairs and execute 100 trades each day. They place a premium on the number over quality when it should be the other way around.

Trading is similar to an extreme sport in that it requires all of your energy, focus, and ability, and you may have to push yourself to 120 percent at times. Rest is an important part of effective trading, just as it is in sports.

Trading more than the market allows is not a good idea. Never chase trading opportunities in the market, and don’t be upset if you miss a five-star trade. There will be more of them in the future.

Set your trading guidelines, and be sure to include your breaks and relaxation periods. Be patient, wait for the right opportunity, then seize it.

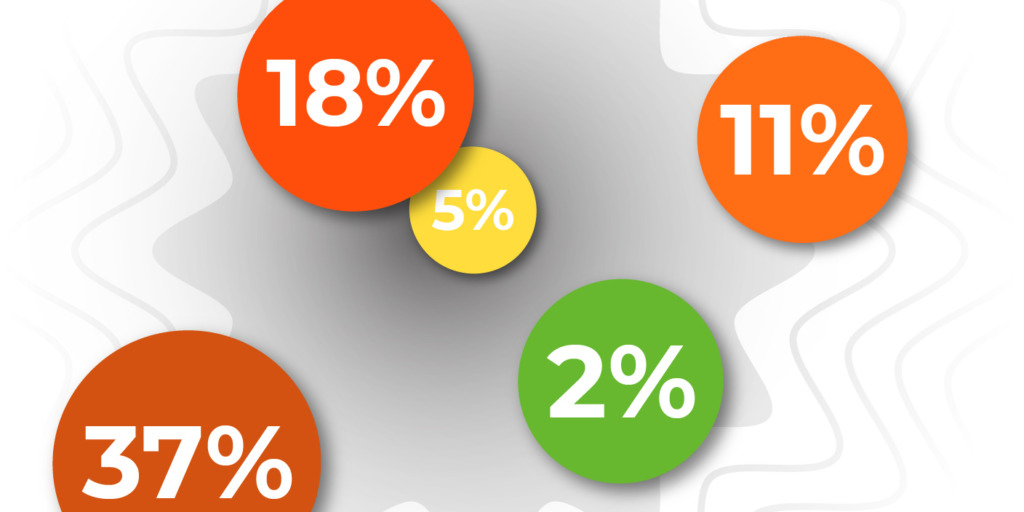

#3. Poor risk management

When trading in the financial markets, risk management is one of the most key aspects to understand. Unfortunately, most new traders overlook risk management concepts until they learn the necessity of risk management the hard way — by blowing their accounts.

Determine your risk-per-trade and reward-to-risk ratios for each transaction before placing it, and make sure they align with your trading plan.

As a risk-per-trade measure, use a set percentage of your trading account — most of the time, risking roughly 2% of your funds on every single trade would do. Make sure you’re risking less than your potential gains regarding reward-to-risk ratios.

For trading to be less risky, risk management is essential. Any trading strategy should include it as a vital and well-thought-out component.

#4. Trading against trend

“The trend is your friend,” you’ve probably heard before. Trading in the direction of the trend can be very beneficial to beginners, as trends can be highly persistent in the markets.

Many new traders look for rapid transactions against the overall trend in the hopes of shorting the very top or bottom of a bull or bear market.

Even for seasoned traders, catching the peaks and troughs of bull and bear movements is tough and risky. Smart traders generally purchase high and sell higher rather than sell low and high.

Even if you have read and digested the best books for new traders, taking advantage of minor ripples during counter-trend swings is significantly less productive than following the crowd and surfing the waves of a trend.

No trading plan

Forex traders often lose money because they do not have an actual trading plan. Many just decide to “wing it” and see if their instincts can get them through. That being said, just as you shouldn’t start a new business without a business plan, you also should not start trading without a trading plan.

The more detailed your plan is, the better it will serve you. However, as a starting point, you should have at least a set entry and entry point. Make sure to keep an eye out on your risk/reward ratio, along with your money management technique.

Chasing after performance

As a trader, your first instinct would be to avoid what has performed poorly in the past and chase the ones that performed superiorly. That being said, the market before may have been different, so a performing trade in the past may not be as efficient in the present.

Similarly, trades that have performed poorly in the past may perform efficiently in the future. It is essential to follow metrics and not buy a trade simply because it used to be popular at some point. Trust your data, but make sure to trust potential as well.

Not regaining balance

As a new trader, your first trading loss can significantly throw you off balance. Whether the loss was your fault or not, it deals a great blow to your confidence. This is very important because, for a trader, confidence is key.

Ideally, you should accept responsibility for potential losses and stick to your strategy. Losses can happen even to the best of day traders, and if you have a good strategy, you should play it out. You’ll regain your balance eventually, as long as you keep your cool.

Ignoring risk aversion

Many investors can’t take the ups and downs often occurring in the stock market, allowing themselves to be influenced by the volatility. At the same time, others with low-risk tolerance want secure trades with regular income. The latter should mostly invest in regular stocks that increase based on interest.

With trading, things are slightly different. Ignoring risk aversion could turn out to be a costly mistake. Even if a specific investment shows attractive returns, you should always take a good look at the risk profile. This will prevent you from investing more than your account can handle.

Forgetting your time horizon

When you invest, you should do so with a time horizon in mind. This will help you determine how fast you can tap into your earnings, along with how you should invest in the long term. Time horizon should help you determine how to approach the market.

For instance, if you want to earn money to buy a home, then a time frame set in the medium term should be enough. However, if you plan to save money for your child’s college education or your retirement, then a long-term frame should work better for you.

Not using Stop-Loss orders

New traders may not know how to take control of their risks, using their instincts to make a sale or purchase. This causes them to either back out of a trade too fast or overstay their position. This can end up in significant loss.

When you are new on the day trading front, your trades should never go over 1% of your account balance. This should be set as both your entry price and your stop-loss price, multiplied by the size of your position along with the number of shares that you have.

Believing false buy signals

Very often, when the price of a stock lowers, investors take it as a sign of market volatility. Often, these prices would lower as a result of higher competition but would increase with time as the competition goes down. The problem is that there is a good chance that these sticks may not go up anytime soon.

This is why it is important to keep your critical eye open, as there are many reasons why a stock would drop. If the prices are suddenly going lower, it might signal a false buy. Do thorough research, and make sure that the company experiences sustained growth.

Underestimating your abilities

Many traders underestimate their ability, thinking that they are no match for the sophisticated traders out there. Sure, you may not have the experience, but it doesn’t mean you’re not as smart as them. In fact, many professional traders are underperforming, even when they have been doing this for a while.

You must trust your ability to make good trades based on thorough research. Remember, with investing, you will mostly need to adhere to rationality and common sense. Even if you are new at this, if you are confident about your investment strategy, you should be able to earn. There’s no reason for you to think you are beneath them, even if you have a day job that keeps you busy.

Conclusion

Trading is a science as well as an art. It’s a science because getting good results requires adhering to standards. It’s an art because markets change all the time, and rules that worked yesterday may not work tomorrow.

Using these tips may not guarantee you a failproof trading journey, but they will help you minimize your troubles.

Finally, make sure you use the best apps for new traders when trading and learn how to trade smartly.